The recently gazetted order of a 10 % increase in property taxes by the Georgetown Mayor and City Council (M&CC) was a decision of the previous council, says Mayor Ubraj Narine adding that the administrative arm of the then council failed to have it processed.

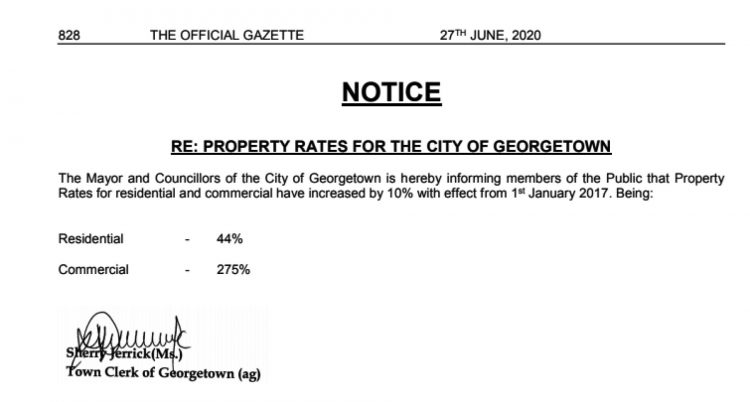

An Official Gazette Order published on June 27, it stated that “The Mayor and Councillors of the City of Georgetown is hereby informing members of the Public that Property Taxes for residential and commercial have increased by 10% with effect from 1st January 2017. Being: Residential – 44% Commercial – 275%.”

Narine yesterday told Stabroek News that while this decision was implemented since 2017. The previous Town Clerks, Sharon Harry-Munroe and Royston King, failed to have the decision gazetted. He noted it was when he assumed office in 2019, that he followed up on the decision and requested that it be gazetted. The mayor stated that he recently had to remind the administration to gazette the order and as a result it was done over the weekend.

He noted that there was no illegal implementation of the new taxes and argued that the additional finances from the taxes have been assisting the council in executing its duties to the citizens.

Meanwhile, Chairman of the City Finance Committee Oscar Clarke echo-ed the statements of the Mayor.

“Yes that was so. The council did take a decision to increase property taxes by 10% in 2017. But the administration never sought to have it gazetted. People have been informed and they are paying the increased rate,” Clarke said last night when contacted.

Bishram Kuppen, PPP Councillor, told Stabroek News that he recalled the council having discussions on the increase and to his knowledge the council did vote on it.

King, the then Town Clerk, he said had informed the council that under Chapter 28.01 of the Municipal and District Councils Act, it is allowed to raise its percentage of the property taxes.

He however disclosed that there were lengthy discussions since properties needed to be appraised and this had to be done by the valuation office at the Ministry of Finance. He noted however, that his party never supported the increase as they felt that persons were already burdened by cost of living and other expenses.

Kuppen said too, from his understanding the increase was for only 2017 and not the other years.

According to Stabroek News archives, reports show that in July 2016, the council had approved the 10% increase of taxes.

The move to hike the rates was recommended by the M&CC’s Finance Committee after a meeting where it reviewed the rate structure for properties. The committee’s report was adopted by way of a motion.

Stabroek News had reported Clarke as saying. “Council must look at the percentage increase across the board and give justifications,” while pointing out that discussions must be held for medium-term and long-term plans for valuation of properties where recommendations are considered important.

Also supporting the increase were Councillor Alfred Mentore and the City Solid Waste Director Walter Narine. Mentore said if the council is going to jack up the rates, the services provided must be excellent and there should not be a scenario where “residents in some areas not being able to access some facilities.”

The Solid Waste Director had said that to his knowledge only Guyana collects commercial waste free-of-cost. He stated that the council is spending millions on a weekly basis to remove waste and businesses are paying limited rates.

In the presentation of the 2017 budget, Clarke had also announced the 10% hike and incorporated the revenue projection into his budget.

Clarke had argued in a February 2017 Stabroek News report that there has been no increase in the percentage assessment of property rates since 1998, while noting that there are a number of unassessed properties both in terms of construction, expansion and change of use.

“Property owners ought to recognise that the rates paid in 1998, based on the size of property then, cannot be applicable now,” Clarke had said.

Meanwhile, the Mayor yesterday told Stabroek News that he has been pushing for a valuation of properties in the city since there are still some businesses on Regent Street paying a minimum of $12,000, while property owners in Queenstown, Georgetown, are paying approximately $16,000.

While Narine said he is against amnesties, the council recently announced that they are waving the interest rate on property taxes for 2020. The move he said is an aid for persons who are struggling as a result of the pandemic.

Narine iterated that the council has set up a special committee to handle requests for waivers on outstanding property taxes. Persons who are facing difficulties or are unable to pay their property taxes can write to the committee headed by Deputy Mayor Alfred Mentore and request a one-on-one engagement with the committee and will be given the opportunity to make their case.

The Mayor said he feels this way, persons will be able to appreciate the service of the council as a special payment plan will be created to suit their pockets.

Narine further stated that over $8 billion of property rates are outstanding and he encouraged persons to reach out to the council to discuss payment plans.